BC’s vehicle insurance landscape is currently in a mess. There is a Civil Resolution Tribunal that may be unconstitutional. Some crash victims still have the right to sue the at fault motorist that injured them. Some are caught in a period of time where they can still sue but deceptively labelled ‘minor injuries’ have capped damages. The constitutionality of that law is being questioned in ongoing litigation. Some crash victims have no right to sue at all. The constitutionality of that law is being questioned. Clear as mud?

Things are, in a word, complex.

One complexity now has a bit more clarity. This is not east to explain succinctly but let me give it a shot.

Crash victims after April 2019 – May 2021 have the right to sue. They can get pain and suffering. If their injuries are deemed ‘minor’ their pain and suffering is capped at about $5,500. If the victim sues in BC Supreme Court and the at fault motorist (almost always insured by ICBC) claims the injuries are minor they can seek an application that the claim be diverted to the Civil Resolution Tribunal.

Because of the pandemic there has basically been a one year extension of the time limit to sue in BC Supreme Court. The BC Civil Resolution Tribunal gave no such courtesy. So in short a crash victim can sue in time in BC Supreme Court, ICBC can hypothetically seek to dismiss the lawsuit and ask that it be ordered to be restarted at the CRT. If a court grants such an order the victim only has a few weeks to start the proceeding there. But what if the claim is beyond two years at the time this happens (the typical limitation period)? Can they refile in the CRT or are they out of time? The BC Government, in all their efforts to stack the deck of the auto insurance system in ICBC’s favour, did not bother clarifying this. It is unclear what the ultimate outcome would be (though there are strong arguments as to why the re-filing should be allowed, I’ll save those for another day).

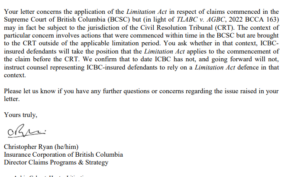

ICBC has decided to back down and not raise this issue. A letter was sent by counsel for ICBC to counsel for plaintiffs in some of the ongoing constitutional challenges where the Crown Corporation agreed to back down. I’ll let the letter speak for itself. Specifically ICBC’s Director Claims Programs & Strategy says that

“The context of particular concern involves actions that were commenced within time in the BCSC but are brought

to the CRT outside of the applicable limitation period. You ask whether in that context, ICBC insured defendants will take the position that the Limitation Act applies to the commencement of the claim before the CRT. We confirm that to date ICBC has not, and going forward will not,

instruct counsel representing ICBC-insured defendants to rely on a Limitation Act defence in that context. ”

A small bit of clarity in a brutally complex legal landscape.

More Stories

The Georgia runoff looks very tight – politicalbetting.com

Wells Fargo Active Cash Card Review

Pele: Brazil legend says he is ‘strong with a lot of hope’